Tuition and fees for in-state public four-year universities have seen their lowest increase in nearly 40 years, but students are still paying more, according to a recent report.

In October the non-profit higher education advocacy group College Board released their annual “Trends in Higher Education” report, showing that slowing of cost increases has not resulted in net cost reduction to students. As state and federal funding has remained stagnant over the last two years, net pricing has increased, according to the report.

“[State funding] certainly has declined dramatically on how much we get per student, and that has required tuition to go up,” said Ron Paradis, director of student relations at COCC. “20 years ago tuition accounted for 20 percent of operating costs; it now accounts for 50 percent.”

Although more money was allocated for community colleges in Oregon during this legislative session, state appropriations throughout the country have gone down 19 percent over the last five years while enrollment increased by 11 percent, according to the report.

Despite a tuition increase in the 2013-2014 academic year, COCC tuition remains the second lowest of all 17 community colleges in Oregon, according to Paradis.

“That’s very important to the board to keep it at the lower level,” Paradis said. “We are very proud of the fact that we are the second lowest.”

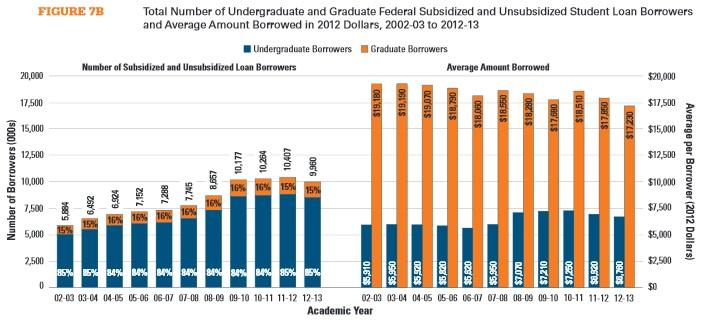

As a result of higher costs, student debt has also increased nationally over the past decade.

In 2011-2012 an estimated 60 percent of bachelor’s degree earners graduated with an average of $26,500 in debt, according to the report.

Kevin Multop, director of financial aid at COCC, sees these loans as a good investment for students, however, citing the relatively low 3.8 percent interest rate.

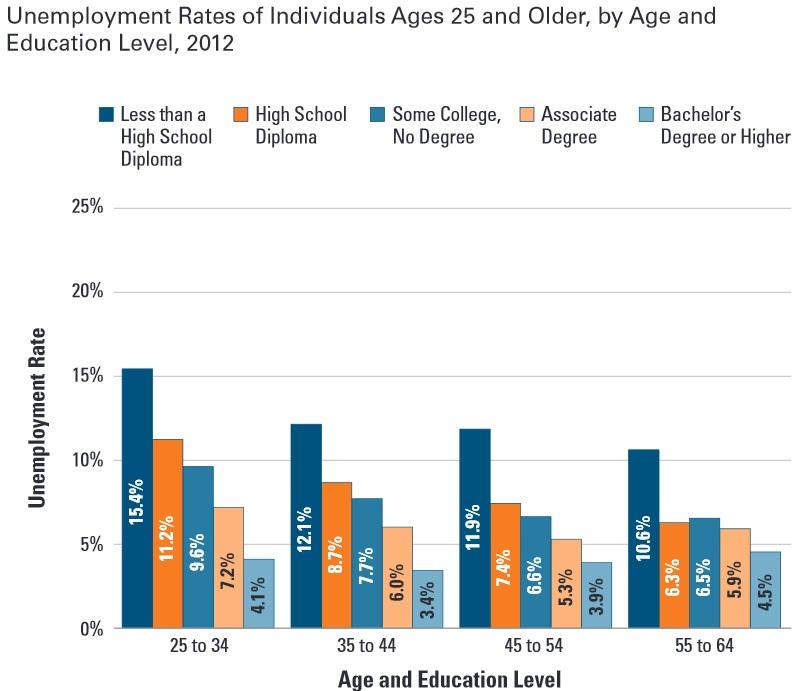

“For many students, it still makes sense to get these loans,” Multop said. “College is still a good deal. It has a direct effect on peoples earning potential.”

In 2011, full time workers with a bachelor’s degree earned $21,000 more than those with only a high school education, according to the report.

Other benefits include healthier lifestyles, more time with children, increased civic activity, and greater opportunity for socioeconomic advancement, the report said.

Even with these benefits, loans should still be managed properly, according to Multop. Resources like the SALT program or the financial aid office are available, as well as researching payment options at studentloans.gov, are available to students, said Multop.

Despite rising costs and potential future debt, the benefits of higher education are still worth it, according to both Multop and Paradis.

“I think what’s important is that individuals look at what it is they want out of life,” Paradis said. “If you are investing in yourself to end up in a career where you will be fulfilled and making money, then that’s a great thing.”

Darwin Ikard

The Broadside